【策略】全天候平衡

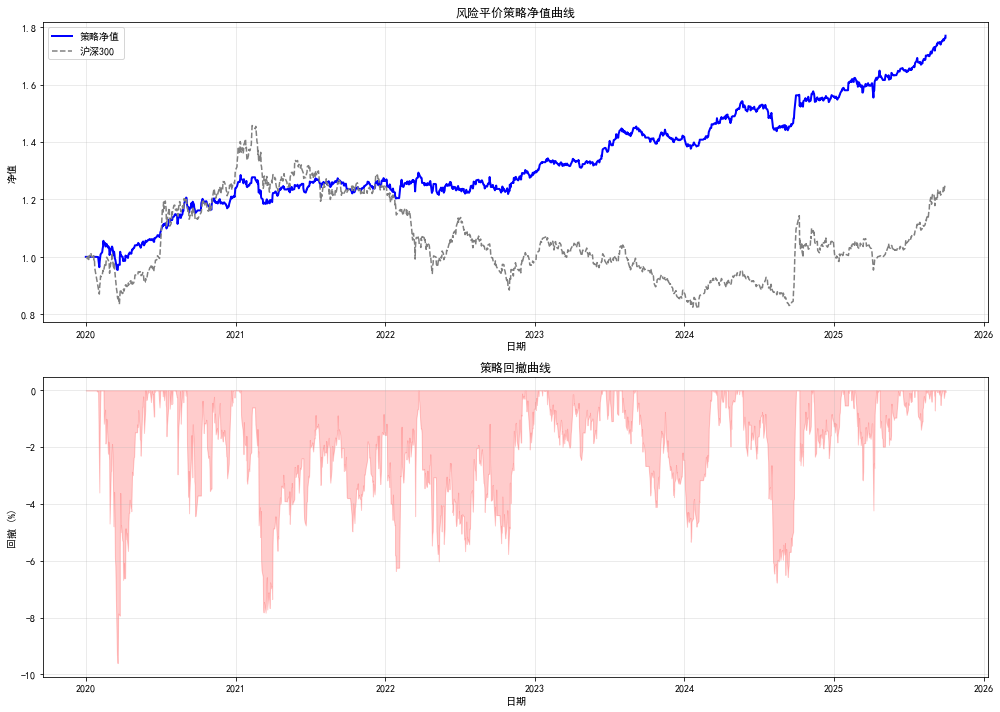

一个直接能够跑的全天候策略【全天候的收益和回撤大概都是10%,感觉没啥意义,没有上到平台】

核心逻辑:基于经济周期的资产匹配

# -*- coding: utf-8 -*-

"""

修复卖出逻辑问题

"""

import pandas as pd

import numpy as np

import akshare as ak

from datetime import datetime, timedelta

import matplotlib.pyplot as plt

import warnings

warnings.filterwarnings('ignore')

# 设置中文字体

plt.rcParams["font.family"] = ["SimHei", ]

plt.rcParams['axes.unicode_minus'] = False

class RiskParityStrategy:

def __init__(self, initial_capital=100000, rebalance_period=20, confidence_level=2.58):

"""初始化风险平价策略"""

self.initial = initial_capital # 初始资金

self.rebalance_days = rebalance_period # 再平衡周期(交易日)

self.confidence = confidence_level # 置信水平

# 资产配置 (代码更简洁的命名)

self.assets = {

'equity': ['510300'], # 沪深300ETF

'commodity': ['518880'], # 黄金ETF

'commodity2': ['159985'], # 豆粕ETF(商品类)

'overseas': ['513100'] # 纳斯达克100ETF

}

self.pool = (self.assets['equity'] + self.assets['commodity'] +

self.assets['commodity2'] + self.assets['overseas'])

# 状态变量

self.cash = initial_capital

self.positions = {stock: 0 for stock in self.pool}

self.transaction = {stock: {

'amount': 0, 'cost': 0, 'buy': 0,

'sell': 0, 'win': 0, 'loss': 0, 'max_loss': 0,

'max_date': None, 'profit': 0, 'price': 0

} for stock in self.pool}

self.daily_prices = {stock: 0 for stock in self.pool}

self.portfolio_value = initial_capital

self.performance = [] # 每日绩效记录

# 回测控制 - 新增交易日计数器

self.trading_days_count = 0

self.hold_cycle = rebalance_period

self.data = {} # 缓存资产数据

def load_data(self, start_date, end_date):

"""批量加载所有资产数据"""

print("正在加载历史数据...")

for category, stocks in self.assets.items():

for stock in stocks:

try:

df = ak.fund_etf_hist_em(symbol=stock, adjust="qfq")

df = df.rename(columns={

'日期': 'date', '收盘': 'close'

})[['date', 'close']]

df['date'] = pd.to_datetime(df['date'])

df = df[(df['date'] >= start_date) & (df['date'] <= end_date)]

df.sort_values('date', inplace=True)

self.data[stock] = df

print(f"已加载 {stock} 数据,共 {len(df)} 条记录")

except Exception as e:

print(f"加载 {stock} 数据失败: {e}")

self.data[stock] = pd.DataFrame()

def get_returns(self, stock, date, lookback=120):

"""获取指定资产的历史收益率"""

df = self.data[stock]

if len(df) < 20:

return np.array([])

mask = df['date'] <= date

if not mask.any():

return np.array([])

end_idx = df[mask].index[-1]

start_idx = max(0, end_idx - lookback)

return df.loc[start_idx:end_idx, 'close'].pct_change().dropna().values

def calculate_es(self, stock, date, lookback=120):

"""计算预期损失(ES)"""

returns = self.get_returns(stock, date, lookback)

if len(returns) < 20:

return 0.01 # 数据不足时返回默认风险值

# 处理置信水平

alpha = 0.01 if self.confidence == 2.58 else 0.05

valid_returns = returns[~np.isnan(returns)]

valid_returns = valid_returns[valid_returns != 0]

if len(valid_returns) == 0:

return 0.01

valid_returns.sort()

threshold = max(1, int(len(valid_returns) * alpha))

if valid_returns[0] >= 0:

return 0.01 # 无负收益时返回默认值

return -np.mean(valid_returns[:threshold])

def calculate_weights(self, date):

"""计算风险平价权重并保留2位小数"""

es_values = [

self.calculate_es(self.assets['equity'][0], date),

self.calculate_es(self.assets['commodity'][0], date),

self.calculate_es(self.assets['commodity2'][0], date),

self.calculate_es(self.assets['overseas'][0], date)

]

max_es = max(es_values + [0.01]) # 确保不为零

# 计算风险平价配置

weights = [max_es / es if es > 0 else 0 for es in es_values]

total = max(sum(weights), 1) # 避免除零

# 归一化权重并保留2位小数

norm_weights = [round(w / total, 2) for w in weights]

return {

self.assets['equity'][0]: norm_weights[0],

self.assets['commodity'][0]: norm_weights[1],

self.assets['commodity2'][0]: norm_weights[2],

self.assets['overseas'][0]: norm_weights[3]

}

def get_holding_ratio(self):

"""获取当前持仓比例"""

if self.portfolio_value <= 0:

return {stock: 0 for stock in self.pool}

holdings = {}

for stock in self.pool:

value = self.positions[stock] * self.daily_prices[stock]

holdings[stock] = value / self.portfolio_value

return holdings

def update_portfolio_value(self, date):

"""更新组合价值并记录绩效"""

total = self.cash

for stock, amount in self.positions.items():

total += amount * self.daily_prices[stock]

self.portfolio_value = total

daily_return = (total / self.initial - 1) * 100

self.performance.append({

'date': date,

'value': total,

'return': daily_return

})

def trade(self, stock, target_ratio):

"""执行交易逻辑"""

price = self.daily_prices[stock]

if price <= 0:

return

target_value = self.portfolio_value * target_ratio

current_value = self.positions[stock] * price

delta = abs(target_value - current_value)

# 交易阈值控制

if delta / max(target_value, 1) < 0.25 or delta < 1000:

return

# 执行交易

if target_value > current_value:

self._buy(stock, target_value, price)

else:

self._sell(stock, target_value, price)

def _buy(self, stock, target_value, price):

"""买入资产(考虑最低1手交易限制)"""

# 计算可买数量(考虑最低1手=100股)

shares = int(target_value / price / 100) * 100

if shares < 100: # 确保至少买入1手

return

cost = shares * price

commission = max(5, cost * 0.0003) # 佣金,最低5元

if self.cash < cost + commission:

return

self.cash -= (cost + commission)

old_amount = self.positions[stock]

old_cost = self.transaction[stock]['cost']

new_amount = old_amount + shares

new_cost = (old_cost * old_amount + cost) / new_amount if new_amount > 0 else 0

self.positions[stock] = new_amount

self.transaction[stock].update({

'amount': new_amount,

'cost': new_cost,

'buy': self.transaction[stock]['buy'] + 1,

'price': max(new_cost, self.transaction[stock]['price'])

})

print(f"买入 {stock} {shares} 股,价格 {price:.2f},金额 {cost:.2f}")

def _sell(self, stock, target_value, price):

"""卖出资产(修复卖出数量计算逻辑)"""

current_amount = self.positions[stock]

if current_amount < 100: # 持仓不足1手不操作

return

current_value = current_amount * price

if target_value >= current_value:

return

# 计算目标股数,确保是100的整数倍

target_amount = max(0, int(target_value / price / 100) * 100)

# 计算需卖出的股数

shares_to_sell = current_amount - target_amount

# 确保卖出数量是100的整数倍且至少卖出1手

if shares_to_sell < 100:

return

# 计算交易成本

sell_value = shares_to_sell * price

commission = max(5, sell_value * 0.0003) # 佣金,最低5元

stamp_duty = sell_value * 0.001 # 印花税

total_cost = commission + stamp_duty

# 更新现金和持仓

self.cash += (sell_value - total_cost)

new_amount = current_amount - shares_to_sell

self.positions[stock] = new_amount

self.transaction[stock]['amount'] = new_amount

# 计算盈亏

old_cost = self.transaction[stock]['cost']

profit = (price - old_cost) * shares_to_sell - total_cost

self.transaction[stock]['profit'] += profit

# 更新交易统计

if profit > 0:

self.transaction[stock]['win'] += 1

else:

self.transaction[stock]['loss'] += 1

if profit < self.transaction[stock]['max_loss']:

self.transaction[stock]['max_loss'] = profit

self.transaction[stock]['max_date'] = datetime.now()

self.transaction[stock]['sell'] += 1

# 更新成本基础

if new_amount > 0:

new_cost = (old_cost * current_amount - price * shares_to_sell) / new_amount

self.transaction[stock]['cost'] = new_cost

else:

self.transaction[stock]['cost'] = 0

print(f"卖出 {stock} {shares_to_sell} 股,价格 {price:.2f},盈利 {profit:.2f}")

def rebalance(self, date):

"""执行资产再平衡"""

weights = self.calculate_weights(date)

# 格式化输出权重,保留2位小数

formatted_weights = {k: round(v, 2) for k, v in weights.items()}

print(f"{date.date()} 风险平价权重: {formatted_weights}")

hold_ratio = self.get_holding_ratio()

trade_list = sorted(

[(stock, weights[stock] - hold_ratio[stock]) for stock in self.pool],

key=lambda x: x[1]

)

# 先处理减仓

for stock, _ in trade_list:

self.trade(stock, weights[stock])

# 再处理加仓

for stock in self.pool:

self.trade(stock, weights[stock])

self.update_portfolio_value(date)

# 重置交易日计数器

self.trading_days_count = 0

def need_rebalance(self):

"""判断是否需要再平衡"""

return self.trading_days_count >= self.rebalance_days

def run_backtest(self, start_date, end_date):

"""运行回测"""

print(f"开始风险平价策略回测,周期: {start_date.date()} 至 {end_date.date()}")

self.load_data(start_date, end_date)

trading_days = pd.bdate_range(start=start_date, end=end_date).tolist()

for date in trading_days:

# 增加交易日计数

self.trading_days_count += 1

# 达到再平衡周期时执行再平衡

if self.need_rebalance():

self.rebalance(date)

# 更新当日价格

for stock in self.pool:

df = self.data[stock]

if len(df) == 0:

continue

mask = df['date'] == date

if mask.any():

self.daily_prices[stock] = df[mask]['close'].values[0]

else:

prev_dates = df[df['date'] < date]['date'].sort_values(ascending=False)

if not prev_dates.empty:

self.daily_prices[stock] = df[df['date'] == prev_dates.iloc[0]]['close'].values[0]

# 更新组合价值

self.update_portfolio_value(date)

# 打印进度

if (date - start_date).days % 60 == 0:

print(f"回测进度: {date.date()}, 组合价值: {self.portfolio_value:.2f}")

self._print_performance()

self._plot_performance()

def _print_performance(self):

"""打印绩效指标"""

if not self.performance:

print("无绩效数据可显示")

return

# 计算关键指标

final_value = self.performance[-1]['value']

total_return = (final_value / self.initial - 1) * 100

days = (self.performance[-1]['date'] - self.performance[0]['date']).days

annual_return = ((1 + total_return/100) **(365/days) - 1) * 100

# 计算最大回撤

df = pd.DataFrame(self.performance)

df['cummax'] = df['value'].cummax()

df['drawdown'] = (df['value'] - df['cummax']) / df['cummax'] * 100

max_drawdown = df['drawdown'].min()

print("\n===== 风险平价策略回测结果 =====")

print(f"初始资金: {self.initial:.2f}")

print(f"最终资产: {final_value:.2f}")

print(f"总收益率: {total_return:.2f}%")

print(f"年化收益率: {annual_return:.2f}%")

print(f"最大回撤: {max_drawdown:.2f}%")

# 打印各资产交易统计

print("\n各资产交易记录:")

for stock in self.pool:

t = self.transaction[stock]

win_rate = t['win'] / (t['win'] + t['loss']) * 100 if (t['win'] + t['loss']) > 0 else 0

print(f"{stock}: 交易{t['buy']+t['sell']}次, 胜率{win_rate:.2f}%, 盈亏{t['profit']:.2f}")

def _plot_performance(self):

"""绘制绩效图表"""

if not self.performance:

print("无绩效数据可绘图")

return

df = pd.DataFrame(self.performance)

plt.figure(figsize=(14, 10))

# 绘制净值曲线

plt.subplot(2, 1, 1)

plt.plot(df['date'], df['value']/self.initial, label='策略净值', color='blue', linewidth=2)

# 添加沪深300基准

if '510300' in self.data and len(self.data['510300']) > 0:

hs300 = self.data['510300']

hs300 = hs300[(hs300['date'] >= df['date'].min()) & (hs300['date'] <= df['date'].max())]

hs300['net_value'] = hs300['close'] / hs300['close'].iloc[0]

plt.plot(hs300['date'], hs300['net_value'], label='沪深300', color='gray', linestyle='--')

plt.title('风险平价策略净值曲线')

plt.xlabel('日期')

plt.ylabel('净值')

plt.grid(True, alpha=0.3)

plt.legend()

plt.tight_layout()

# 绘制回撤曲线

plt.subplot(2, 1, 2)

df['cummax'] = df['value'].cummax()

df['drawdown'] = (df['value'] - df['cummax']) / df['cummax'] * 100

plt.fill_between(df['date'], df['drawdown'], 0, color='red', alpha=0.2)

plt.title('策略回撤曲线')

plt.xlabel('日期')

plt.ylabel('回撤 (%)')

plt.grid(True, alpha=0.3)

plt.tight_layout()

plt.show()

# 运行回测

if __name__ == "__main__":

strategy = RiskParityStrategy(initial_capital=50000)

start_date = datetime(2020, 1, 1)

end_date = datetime(2025, 9, 30)

strategy.run_backtest(start_date, end_date)

上一篇:3种ETF动量策略有什么区别 下一篇:QMT服务器和云服务器怎么选择

次方量化-技术博客

次方量化-技术博客

发表评论:

◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。