千问AI:区间涨幅动量轮动(3)

现在AI已经牛到,你只需要讲中文,给他一些知识库的内容,他就可以给你写量化策略,然后按照你的要求做优化和提升。

对AI的任务需求:

用akshare数据源写一个ETF趋势交易的轮动策略

豆包提示词:

#通过Akshare获取数据源,返回字段 date open high low close volume,5开头的基金是sh,1开头的基金是sz,把里面的条件尽量参数化

import akshare as ak

fund_etf_hist_sina_df = ak.fund_etf_hist_sina(symbol="sh510050")

print(fund_etf_hist_sina_df)

plt.rcParams["font.family"] = ["SimHei"]

import akshare as ak

import pandas as pd

import numpy as np

import time

# ========== 配置参数 ==========

etf_pool = [

"sh510300", # 沪深300ETF

"sh510500", # 中证500ETF

"sh512880", # 证券ETF

"sh512660", # 军工ETF

"sh513500", # 标普500ETF

"sh513100", # 纳指ETF

"sh513130", # 恒生科技ETF

"sz159915", # 创业板ETF

]

start_year = 2018

end_date_str = "2025-11-01"

momentum_window = 20 # 动量窗口(交易日)

top_k = 1 # 选Top 1

# ========== 获取数据 ==========

etf_data_dict = {}

for symbol in etf_pool:

try:

print(f"正在获取 {symbol} 数据...")

df = ak.fund_etf_hist_sina(symbol=symbol)

df['date'] = pd.to_datetime(df['date'])

df.set_index('date', inplace=True)

df.sort_index(inplace=True)

etf_data_dict[symbol] = df

time.sleep(0.3)

except Exception as e:

print(f"❌ 获取 {symbol} 失败: {e}")

# ========== 构建价格矩阵 ==========

all_dates = sorted(set.union(*[set(df.index) for df in etf_data_dict.values()]))

price_df = pd.DataFrame(index=all_dates)

for symbol, df in etf_data_dict.items():

price_df[symbol] = df['close']

price_df = price_df.loc[f"{start_year}-01-01":end_date_str].sort_index().ffill().dropna(how='all')

price_df.dropna(how='all', inplace=True)

if price_df.empty:

raise ValueError("价格数据为空,请检查ETF代码或网络")

# ========== 找出每周第一个交易日 ==========

trading_days = price_df.index

rebalance_dates = []

for i, date in enumerate(trading_days):

if i == 0:

rebalance_dates.append(date)

else:

prev = trading_days[i - 1]

if date.week != prev.week or date.year != prev.year:

rebalance_dates.append(date)

weekly_rebalance_dates = pd.DatetimeIndex(rebalance_dates)

# ========== 初始化持仓序列(修复版)==========

position_series = pd.Series([[] for _ in range(len(price_df))], index=price_df.index)

# ========== 执行每周调仓 ==========

for date in weekly_rebalance_dates:

lookback_start = date - pd.Timedelta(days=momentum_window * 2)

window_data = price_df.loc[lookback_start:date]

if len(window_data) < momentum_window:

continue

returns = (window_data.iloc[-1] / window_data.iloc[0]) - 1

returns = returns.dropna()

if returns.empty:

continue

top_symbols = returns.nlargest(top_k).index.tolist()

position_series[date] = top_symbols

# 向前填充持仓

position_series.ffill(inplace=True)

# ========== 计算策略收益 ==========

strategy_ret = pd.Series(index=price_df.index, dtype=float)

strategy_ret.iloc[0] = 0.0

for i in range(1, len(price_df)):

today = price_df.index[i]

yesterday = price_df.index[i - 1]

holdings = position_series[today]

if not holdings:

strategy_ret[today] = 0.0

else:

daily_rtn = 0.0

valid_count = 0

weight = 1.0 / len(holdings)

for sym in holdings:

if pd.notna(price_df.loc[yesterday, sym]) and pd.notna(price_df.loc[today, sym]):

ret = price_df.loc[today, sym] / price_df.loc[yesterday, sym] - 1

daily_rtn += weight * ret

valid_count += 1

strategy_ret[today] = daily_rtn if valid_count > 0 else 0.0

strategy_nav = (1 + strategy_ret).cumprod()

# ========== 基准 ==========

benchmark_symbol = "sh510300"

benchmark_nav = price_df[benchmark_symbol] / price_df[benchmark_symbol].iloc[0]

# ========== 输出结果 ==========

def annual_return(nav, freq=252): return nav.iloc[-1] ** (freq / len(nav)) - 1

def max_drawdown(nav):

rm = nav.cummax()

return ((nav - rm) / rm).min()

print(f"策略年化收益: {annual_return(strategy_nav):.2%}")

print(f"基准年化收益: {annual_return(benchmark_nav):.2%}")

print(f"策略最大回撤: {max_drawdown(strategy_nav):.2%}")

print(f"调仓次数: {len(weekly_rebalance_dates)}")

# ========== 绘图 ==========

import matplotlib.pyplot as plt

plt.figure(figsize=(12, 6))

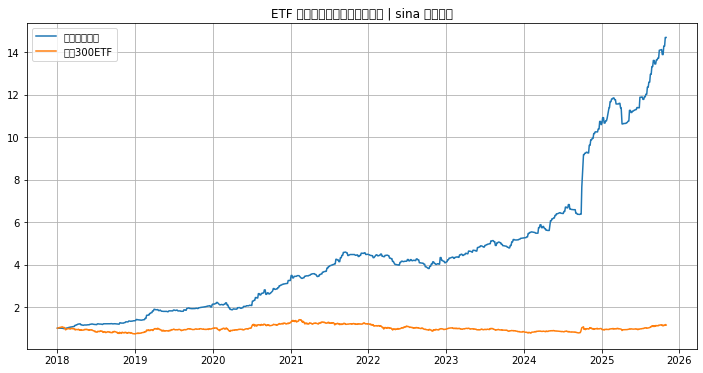

plt.plot(strategy_nav, label='每周轮动策略')

plt.plot(benchmark_nav, label='沪深300ETF')

plt.legend()

plt.title('ETF 趋势轮动策略(每周一调仓 | sina 数据源)')

plt.grid(True)

plt.show()

策略年化收益: 42.85%

基准年化收益: 1.87%

策略最大回撤: -16.83%

调仓次数: 403

上一篇:安装本地的Python运行环境 下一篇:动量策略为啥有时候会失效?

次方量化-技术博客

次方量化-技术博客

发表评论:

◎欢迎参与讨论,请在这里发表您的看法、交流您的观点。